At Ummat Tax Law, we contribute tax articles and commentary to the greater tax community in a meaningful way by reviewing and analyzing new rules and case law regularly.

Good writing is clear, concise, and simplifies the complex.

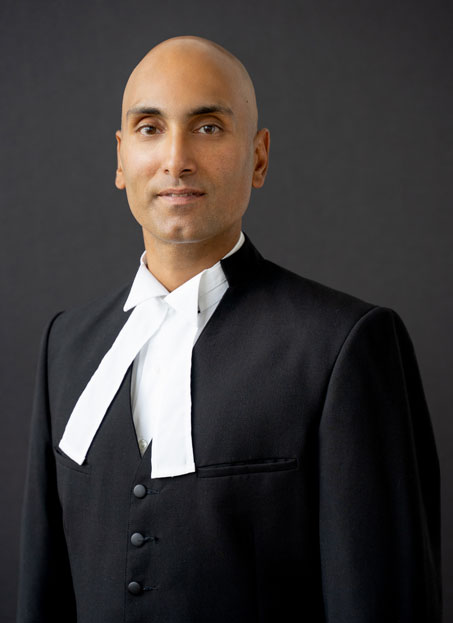

AMIT UMMAT

RECENT TAX ARTICLES

Navigating Jurisdictional Boundaries: Implications of Recent Supreme Court of Canada Decisions on Tax Disputes

Navigating Jurisdictional Boundaries: Implications of Recent Supreme Court of Canada Decisions on Tax Disputes By: Amit Ummat On June 28, 2024, the Supreme Court of Canada (“SCC”) released concurrent judgments in Dow Chemical Canada ULC [...]

John Tavares Owes the Government of Canada $8 Million in Unpaid Taxes

John Tavares Owes the Government of Canada $8 Million in Unpaid Taxes By: Amit Ummat Ummat Tax Law PC Barristers & Solicitors 5500 North Service Road, Suite 302 Burlington, ON L7L 6W6 (905) 336-8924 John [...]

Huge Costs Award Against the Minister (Tax Court of Canada)

Crown’s Actions Lead to Marine Atlantic Being Awarded $895,731 in Costs DECISION HERE By: Amit Ummat In Marine Atlantic Inc. v. The King 2024 TCC 51 (the “Case”), Justice Steven K. D’Arcy was tasked with [...]