At Ummat Tax Law, we contribute tax articles and commentary to the greater tax community in a meaningful way by reviewing and analyzing new rules and case law regularly.

Good writing is clear, concise, and simplifies the complex.

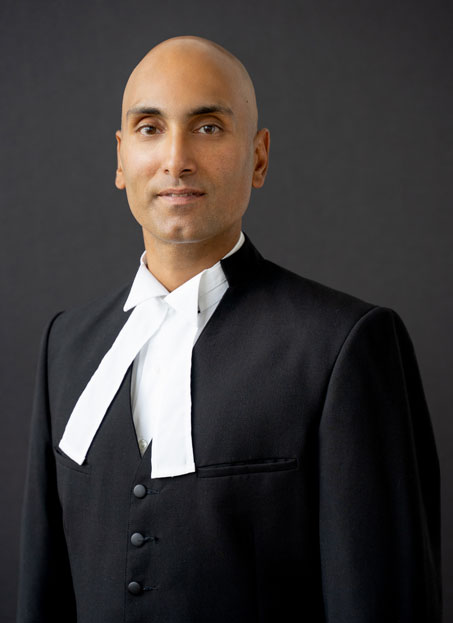

AMIT UMMAT

RECENT TAX ARTICLES

CRA Ordered to Pay Interest to Taxpayer

Federal Court Rules Interest Payable on Amount Refunded to Taxpayer Glatt v. Canada (National Revenue) 2019 FC 738 (Glatt Decision Here) Summary This case deals with the question of whether the Minister had an obligation to [...]

Net Worth Assessments Explained

CRA’s Last Resort: The Dreaded Net Worth Assessment Background Many aspects of the Canada Revenue Agency (“CRA”) and its tax collection measures trouble the average Canadian. But likely the most troublesome -- and controversial -- [...]

Gross Negligence Penalties Primer

Gross Negligence Penalties CRA Must Prove Penalty Applies What many people under audit find is that, in addition to proposing adjustments to income tax payable, the CRA will also apply penalties. There are various penalties [...]