At Ummat Tax Law, we contribute tax articles and commentary to the greater tax community in a meaningful way by reviewing and analyzing new rules and case law regularly.

Good writing is clear, concise, and simplifies the complex.

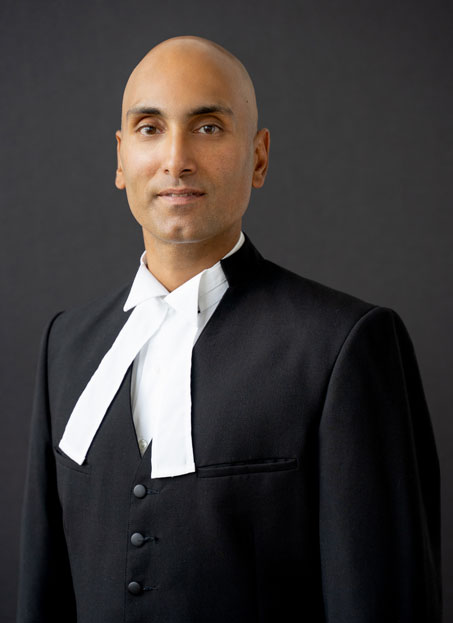

AMIT UMMAT

RECENT TAX ARTICLES

Good Advice for Small Business During a Pandemic

Good Advice for Small Business During a Pandemic [This article was originally published by the Lawyers Daily in March 2020] The economic impact relating to the Covid-19 virus will be felt by every corner of [...]

FCA Includes Taxes Payable in Computation of Safe Income

Federal Court of Appeal Includes Taxes Payable in Computation of Safe Income Access Decision Here 626468 New Brunswick Inc. v. Her Majesty the Queen 2019 FCA 306 Summary The Federal Court of Appeal (“FCA”) dismissed [...]

The FCA Refuses to Apply the GAAR in Treaty Benefits Case

Canada v. Alta Energy Luxembourg S.A.R.L. 2020 FCA 43 ACCESS ALTA ENERGY DECISION HERE Summary The Respondent Alta Energy Luxembourg (Alta Luxembourg) argued at the Tax Court of Canada (TCC) that the large taxable capital [...]