At Ummat Tax Law, we contribute tax articles and commentary to the greater tax community in a meaningful way by reviewing and analyzing new rules and case law regularly.

Good writing is clear, concise, and simplifies the complex.

AMIT UMMAT

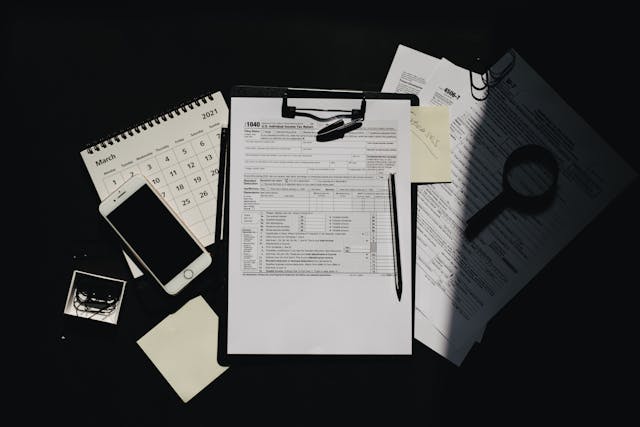

RECENT TAX ARTICLES

Why I Choose to Work from an Office and not Remotely

Why I Choose to Work from an Office and not Remotely People regularly ask me, 'why do you have this office? A lot of other tax lawyers work remotely.' Having an office is important to [...]

When Should a CPA Call a Tax Litigator?

When Should a CPA Call a Tax Litigator? Most tax disputes are resolved long before a courtroom is ever involved. In many cases, a skilled CPA can manage compliance issues, respond to routine audit queries, [...]

The Role of a Tax Litigator During a Corporate Audit

The Role of a Tax Litigator During a Corporate Audit A corporate tax audit is not merely an accounting exercise. It is a structured adversarial process that can evolve—sometimes quickly—from information gathering to reassessment and, [...]